Maximize your potential: personalized trading consulting for success

Simple and easy steps

Embarking on the journey of trading and investing, one thing is certain: no one said this job is supposed to be easy. But then again, no one said it's supposed to be that hard either. With the right knowledge and guidance, navigating the markets becomes more manageable. Let us help you find that balance.

What we do

A peek into how we can guide you

Trading and investing consultation

Our consultation services offer personalized guidance tailored to your trading style and goals. From strategy development to risk management, we provide expert insights to help you navigate the markets with confidence. The best of it, we're going to make it simple.

Data analysis

Our educational sessions offer comprehensive guidance and resources to deepen your understanding of trading. From fundamental principles to advanced strategies, gain the knowledge and skills needed to excel in the dynamic world of finance, albeit trading or investing we're talking about.

Tips and tricks

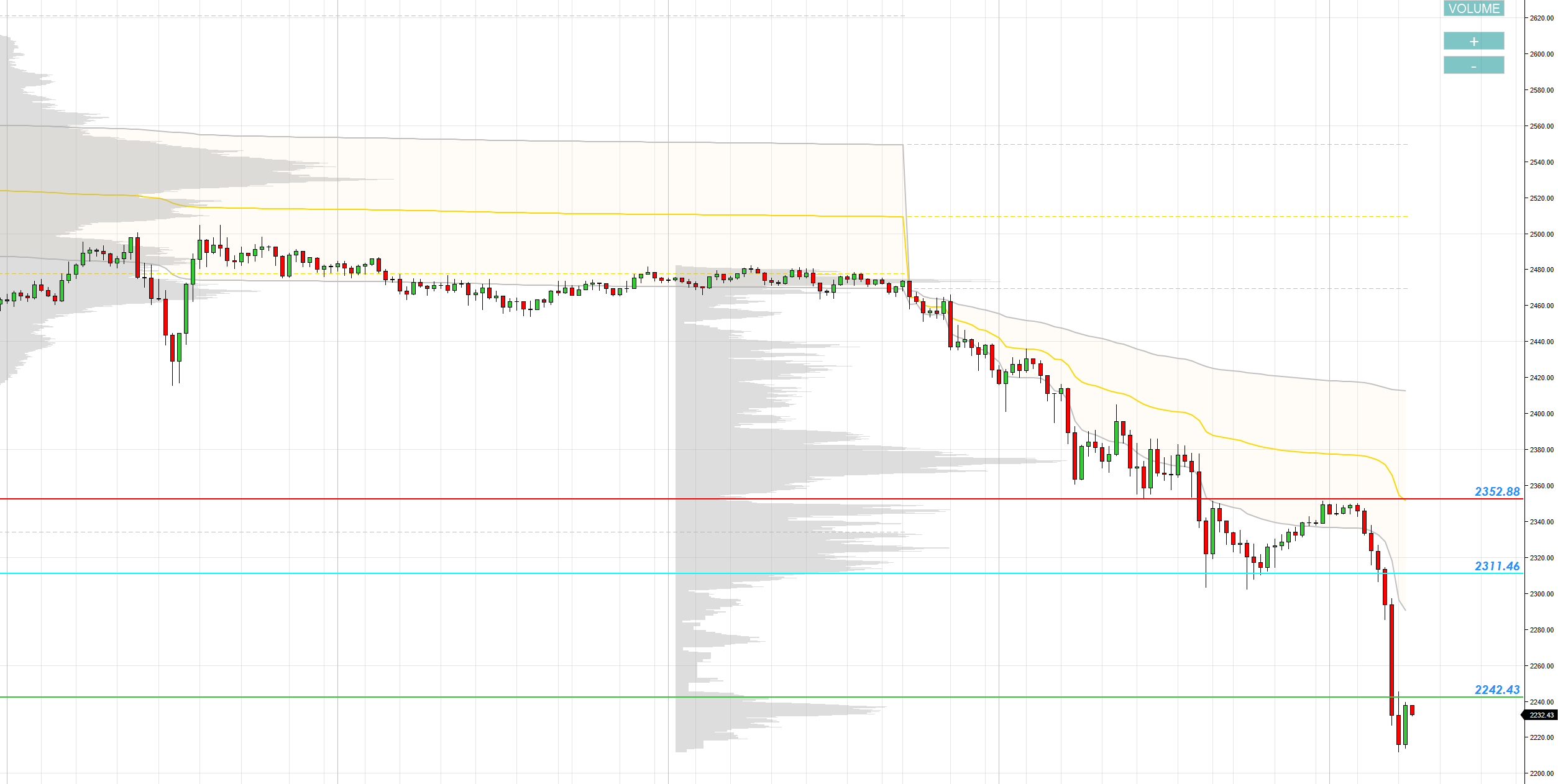

Our tips and tricks sessions deliver actionable insights and strategies to sharpen your trading edge. From spotting trends to managing risk, unlock the secrets to successful trading and elevate your performance in the markets.

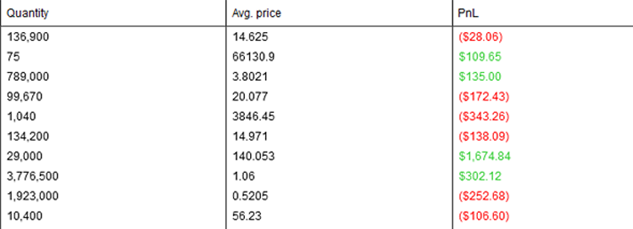

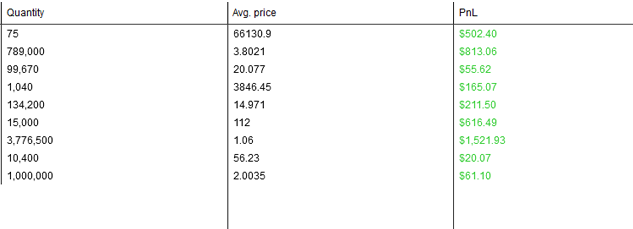

Profits

Before reflecting on trading psychology, position management is emotional and inconsistent, and profits feel out of reach. You have to weather that storm of losses and mistakes first. After reflection, with discipline and strategy, you gain control—unlocking steady profits and clearer skies ahead.

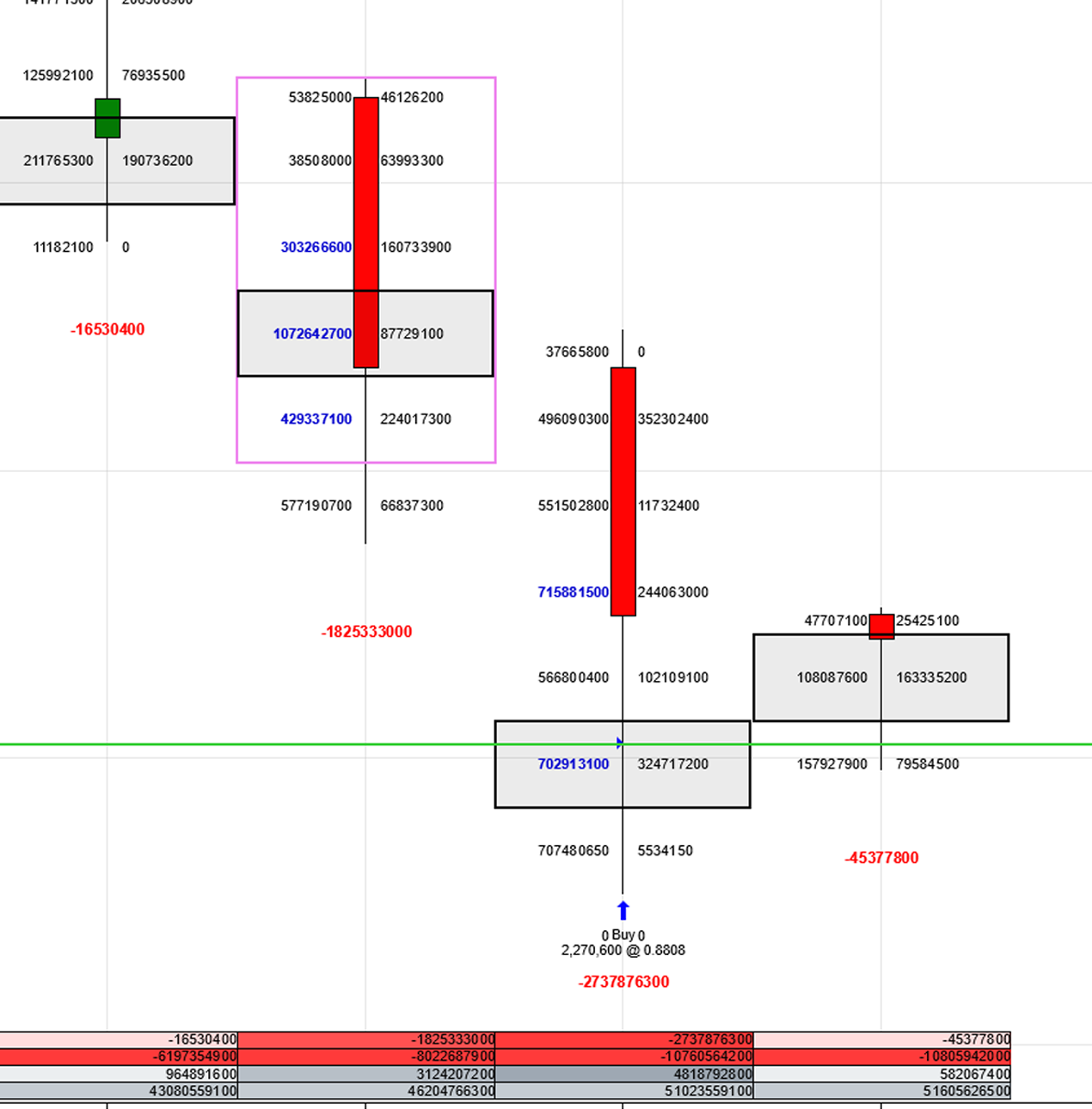

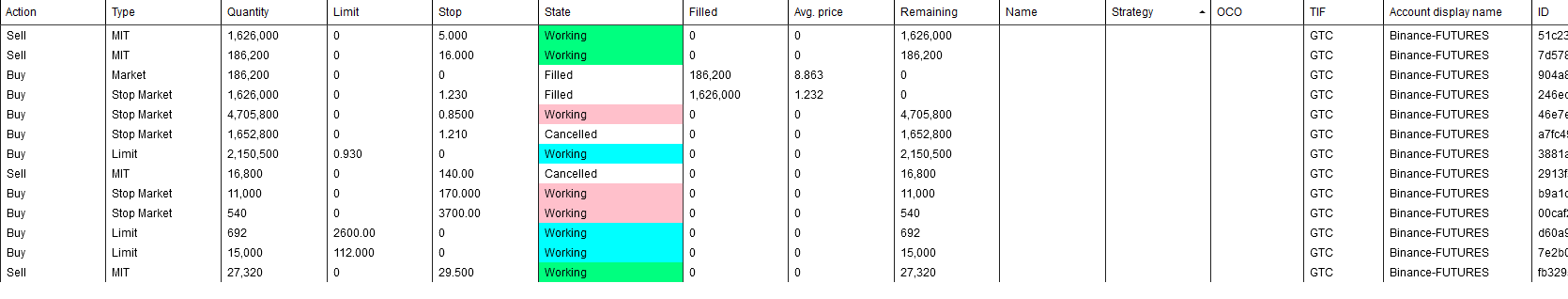

LEARN HOW TO PLACE ORDERS

Learning how to place orders is a crucial step for trading forex, crypto spot, and crypto futures on platforms like Binance and Coinbase. Start by understanding basic order types—market, limit, stop-loss, and take-profit—and when to use each. Use platform tools like order books, charts, and price alerts to time your entries and exits better. For crypto futures, also learn about leverage and margin to manage risk effectively. Practicing with demo accounts or small trades helps build confidence before scaling up. Mastering these tools lets you trade smarter across different markets.